ICAP: A New Paradigm in Transfer Pricing Certainty

Transfer pricing is increasingly viewed as a top concern for tax audits. Disputes in this area can be expensive, time-consuming, and disruptive, and they can significantly affect the performance of multinational enterprises (MNEs). Previously, Advanced Price Agreements (APAs) were the primary tool for MNEs seeking to ensure certainty in transfer pricing. The Organisation for Economic Co-operation and Development (OECD) has recently established a new program aiming at assisting MNEs manage transfer pricing risk so called the International Compliance Assurance Program (ICAP). Similarly, to APAs, ICAP is a voluntary program intended to help MNEs managing transfer pricing risks proactively.

This article will provide with a brief background, followed by an overall explanation of ICAP, then give a high-level comparison between ICAP and the APA option, and some final thoughts on what can be expected in terms of its adoption.

The OECD BEPS Plan

The BEPS (Base Erosion and Profit Shifting) Plan originally published in 2015 consisted of a series of 15 specific action items developed by the OECD to address issues related to tax avoidance by multinational enterprises (MNEs). As of today, over 137 countries have joined (participant countries) the OECD/G20 Inclusive Framework on BEPS created in 2016 as a broader effort to implement the BEPS Plan recommendations [1]. At their core of the BEPS Plan is the increase of tax transparency. Specifically, Action 13: Country by Country Reporting (CbCR) [2] and Action 14: Mutual Agreement Procedure (MAP) provide minimum standard recommendations to enhance tax transparency.

The CbCR requires the parent of MNEs to disclose aggregate data on the global allocation of income, profit, taxes paid, and economic activity amongst tax jurisdictions in which MNEs operate in such a standardized way that can be shared with tax administrations for use in high-level transfer pricing and BEPS risk assessments. Whereas, the MAP seeks to improve the resolution of tax-related disputes between jurisdictions [3]. The first exchanges of CbCRs took place in June 2018. According to the OECD, tax administrations are incorporating CbCRs into their tax risk assessment and assurance processes to get a better understanding of the risks their jurisdictions are exposed to. Precisely, the CbCRs are expected to be a key element of the alternatives available to provide greater tax certainty to MNEs, including the OECD ICAP.

OECD ICAP

The OECD ICAP was launched to be a voluntary risk assessment and assurance program that helps MNEs to obtain increased certainty over their transfer pricing and other international tax issues. The first roll-out of ICAP was announced in December 2020, following two pilots initiated in 2018 and 2019 [4]. Its main goals include being a faster and clearer route to multilateral tax certainty for MNEs as well as an effective and collaborative alternative to dispute resolution to reduce the inventory of MAP cases. It also aspires to prevent unnecessary tax disputes while using tax authorities resources efficiently.

Currently, 22 countries currently participate in the ICAP process [5]. The OECD is continuing to work to expand the number of participating countries, particularly in Asia, Africa, and South America.

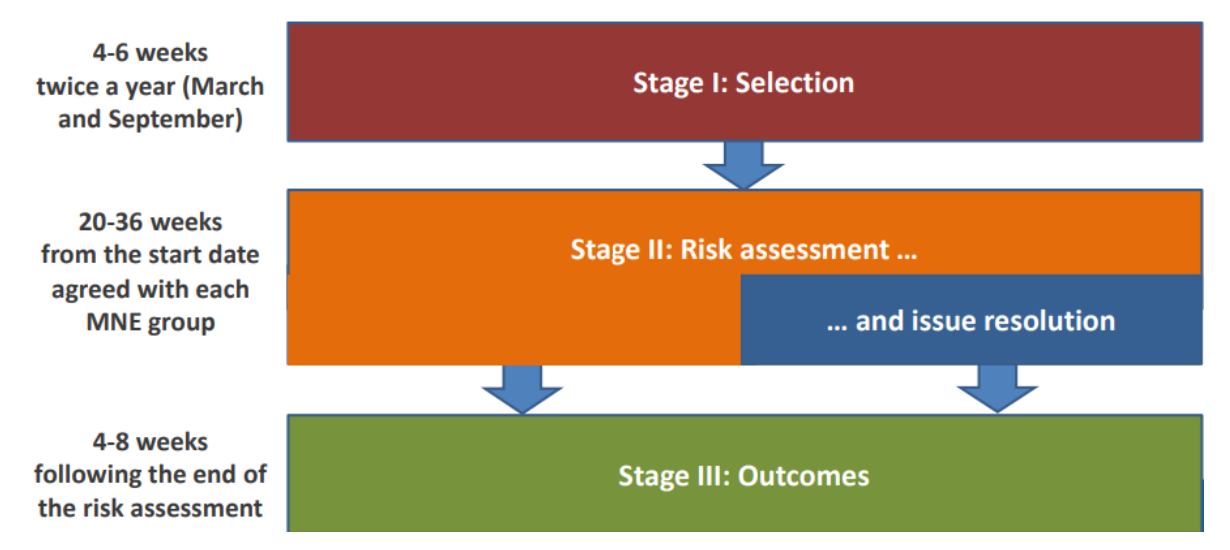

The ICAP process comprehends 3 stages: Stage I – Selection (two application deadlines each year March and September), Stage II – Risk Assessment and Stage III – Outcomes. During the Selection Stage, the ICAP process is initiated with a request from an MNE group to its lead tax administration which ultimately decide if they will join the MNEs group’s ICAP (between 4 to 6 weeks). The Risk Assessment Stage starts with the delivery of a standard package of documentation (between 20 to 36 weeks). During the Outcomes Stage, each tax administration will issue an outcome letter containing the outcomes of its risk assessment, concluding if the covered transactions are considered low risk in which case tax administration does not anticipate any additional enquiries to be needed for the periods covered by the risk assessment (between 4 to 6 weeks).

The following figure prepared by the OECD summarizes the ICAP process.

Figure 1: The ICAP Process [6]

ICAP in the United States

[7] Soon after the OCDE released ICAP Frequent Asked Questions (FAQ) on its website in 2021, the Internal Revenue Service (IRS) did the same showing its support to this initiative while providing further information.

The IRS recommends starting with an initial consultation before submitting the application package which typically includes the MNE Group’s most recent CbCR, master file, transfer pricing reports and financial statements. IRS will review all transfer pricing transactions in which the United States is a counterparty, even if the jurisdiction in which the counterparty is located is not participating in ICAP. While transactions subject to pending and completed bilateral APAs will be excluded from review in ICAP.

There is no fee for an U.S. MNES to participate in the ICAP, however the acceptance cannot be guaranteed. IRS will consider several factor in assessing suitability for ICAP as for instance the type and materiality of the MNE group’s covered transactions and the MNE group’s transfer pricing examination history with the IRS.

In the case the IRS concludes that a transaction is no low-risk and instead presents a potential compliance risk, it will not necessarily lead to an examination. An optional issue resolution process is offered for the MNE and the relevant tax administrations to reach an agreement within the ICAP process on the tax treatment of a covered transaction. Furthermore, issues that cannot be resolved in ICAP may be addressed through other traditional dispute resolution processes as appropriate, bilateral/multilateral APA.

In April 2023, the IRS released the memorandum to IRS Treaty and Transfer Pricing Operations (“TPPO”) titled “Interim Guidance on Review and Acceptance of Advance Pricing Agreement (APA) Submissions” which created a prefiling review process regarding the suitability of the case for the APA process. Under this new approach the IRS will review the taxpayer APA request with the potential outcome of the recommendation for the taxpayer’s case to the alternative solutions of ICAP or joint audit. The IRS is expected to soon release the highly anticipated revised APA revenue procedure.

ICAP versus Other Alternatives to Increase Tax Certainty

The OECD’s Transfer Pricing Guidelines recognizes the APAs [8] as the best tool available to increase the level of transfer pricing certainty between jurisdictions, since they have proved to be able to reduce double taxation situations and proactively prevent transfer pricing controversies.

ICAP and APA programs have similarities, both are voluntary tools aiming at increasing transfer pricing certainty. Both programs require taxpayer participation and the involvement not only of professional staff with deep understanding of transfer pricing procedural aspects but also entail discussions between governments. This latter may discourage the adoption of unreasonable positions by participant governments on the transfer pricing issues.

ICAP and APA programs can also differ significantly. The level of legal certainty an MNE group obtains from ICAP is less than from an APA, however the timeframe for an ICAP risk assessment is considerable shorter, 6 to 12 months compared with 3 to 4 years for a bilateral APA. ICAP potentially covers all of an MNE group’s transfer pricing positions risks in covered jurisdictions, rather than only over specific transactions included in an APA. Also, under ICAP, risk assessment opinion is typically provided by 6 to 8 tax administrations, rather than just 2 under a bilateral APA. ICAP can be considered more advantageous in relation to costs, since preparing and participating in the program are low compared to the costs of participating in APAs. In addition, ICAP do not require as many resources from MNE since its documentation requirements generally include information MNEs have already available and interaction with tax administration is more expeditive.

The ICAP is not a replacement for a bilateral or multilateral APA, but may complement these tax certainty tools by providing a straightforward alternative to greater risk mitigation for certain intercompany transactions. Furthermore, the ICAP may help to identify the transactions worthy to be covered under an APA and also may be a less resource intensive alternative for an APA renewal.

Conclusion

Despite the ICAP program is still new and the number of ICAP processes conducted is relatively small, it has already been welcomed by an increasing number of tax authorities and has proved itself to be a viable multilateral transfer pricing certainty option. Statistics about the ICAP program recently released by the OECD [9] show the ICAP is not only faster than APA and MAP processes but also can offer the option of informal dispute resolution.

The ICAP alternative may be more attractive to MNEs than APA in certain circumstances.

For further information please contact:

Sophia Castro

Transfer Pricing Manager

Marcum LLP*, Windsor,Colorado, USA

Email: sophia.castrojurado@marcumllp.com

[1] Action 8, addressing intangibles; Action 9, providing guidance on the allocation of risks and capital in transfer pricing arrangements; Action 10, proposing changes to the transfer pricing rules related to low-value intra-group services; and Action 13, recommending a new standard for transfer pricing documentation.

[2] Action 13 introduced a three-tiered approach for transfer pricing documentation, including the preparation of not only a CbCR but also a master file, and a local file.

[3] Action 14 consists of 21 elements and 12 best practices in the following four key areas: i. preventing disputes; ii. availability and access to MAP; iii. resolution of MAP cases; and, iv. implementation of MAP agreements.

[4] In February 2021, the OECD Forum on Tax Administration (FTA) released the ICAP Handbook, prepared based on feedback from tax administrations and MNE groups, including those with direct experience from the two pilots run in 2018 and 2019 with 8 and 19 participating tax administrations respectively.

[5] Australia, Austria, Belgium, Canada, Colombia, Denmark, Finland, France, Germany, Ireland, Italy, Japan, Luxembourg, Netherlands, Norway, Singapore, Poland, Russia, United States, Spain, and United Kingdom.

[6] Downloaded from https://www.oecd.org/tax/forum-on-tax-administration/ICAP-awareness-session-2021-presentation.pdf

[7] Source: International Compliance Assurance Program (ICAP) Frequently Asked Questions downloaded from https://www.irs.gov/businesses/international-businesses/international-compliance-assurance-program-icap-frequently-asked-questions.

[8] APAs are a voluntary legally binding agreements between a taxpayer and the tax administration determining transfer pricing methodology for future years. APAs can be unilateral (between the taxpayer and one tax authority) or bilateral BAPA (between the taxpayer and two or more tax authorities).

[9] ICAP Results and Statistics (October 2023) presented during the OECD Tax Certainty Day webcast released by the OECD on November 14, 2023.

*Marcum LLP is a separate and independently owned and operated firm that cooperates with ECOVIS International and provides accounting, tax, and audits services in the United States of America. Marcum LLP is not a member of the ECOVIS International network.