Foreign investment enterprise (FIE) in China: Guide to the annual compliance procedures

Foreign invested enterprises (FIEs) in China are required by law to submit an annual compliance report, which includes the annual audit report and the annual tax reconciliation. Failure to comply with these requirements could lead to severe consequences, such as the revocation of business licenses. The experts from Ecovis Heidelberg and Ecovis Ruide Shanghai explain how affected companies should correctly prepare the annual report.

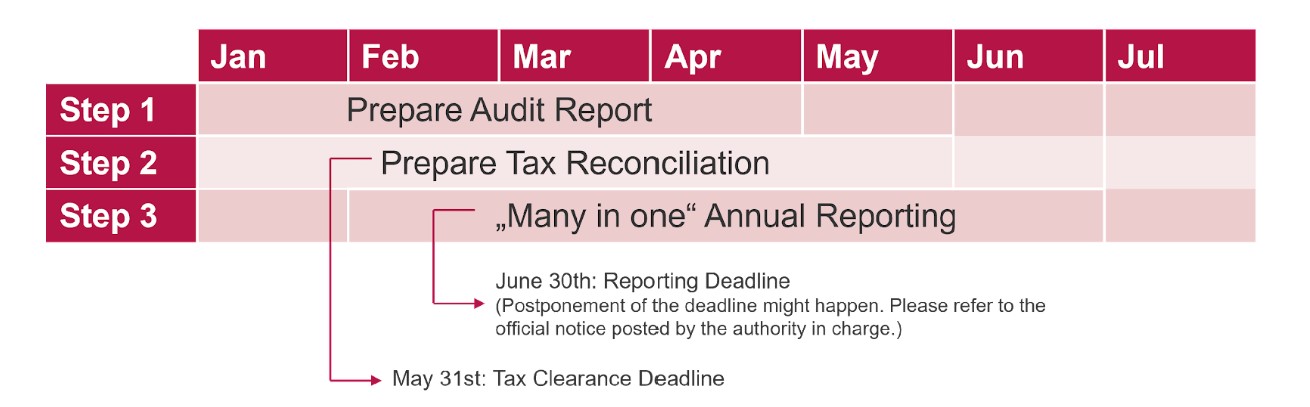

A step-by-step guide to the annual compliance procedures for FIEs in China

Step 1: Preparation of the annual audit report

The annual audit report should be prepared by a qualified accounting firm and signed by two certified public accountants registered in China. The deadline for submitting the report is the end of April, as annual tax filing starts in May.

Step 2: Conduct corporate income tax reconciliation

The deadline for conducting the annual corporate income tax (CIT) reconciliation and filing is 31 May. FIEs have a time frame of five months from the year before to determine whether all tax liabilities are met or if a payment of supplementary tax is necessary. Only the CIT requires an annual reconciliation to the tax bureau at the company level.

Step 3: “Many-in-one” annual reporting

The deadline for the “many-in-one” annual reporting is 30 June. FIEs must report to multiple government bureaus, certifying their compliance and updating every department’s information accordingly. Among other things, the report must include basic company information, investor profile, URL of the company website and online shop, information concerning equity change, the balance sheet, and company operation.

With our many years of experience, we can support you in preparing the annual compliance report.Richard Hoffmann, Lawyer, Ecovis Heidelberg, Germany

The consequences of not meeting requirements

Failure to submit the annual compliance report within the given deadline, fraudulent evidence, or the detection of severe concealment will result in the company being entered into the Catalogue of Enterprises with Irregular Operations. Staying on this list for more than three years could lead to severe consequences, such as being blacklisted for operations and investments in the future.

Therefore, it is essential for foreign companies operating in China to pay close attention to their legal and regulatory compliance. The best strategy is to work with a professional advisor who can cover both the legal and financial aspects for the company.

For further information please contact:

Richard Hoffmann, Lawyer, Ecovis Heidelberg, Germany

Email: richard.hoffmann@ecovis.com

Contact us:

Richard Hoffmann

ECOVIS European China desk

Lenaustrasse 1269115 Heidelberg

Phone: +49 6221 9985 639

www.ecovis.com/heidelberg