Electronic Book Preservation Act Japan

In consideration of the difficulty of actually implementing the Electronic Book Preservation Act, there was a two-year transition period prior to enforcement. The revision will affect all companies in Japan once it comes into force. From 1 January 2024, electronically stored information (ESI) must be preserved under the revised Act. The Ecovis experts explain how it is implemented in practice.

1. Prevent any unauthorised corrections and/or deletions

Businesses should prepare written administrative rules to prevent any unauthorised corrections and/or deletions of the ESI. ECOVIS APO will support the preparation of these written rules.

2. Appropriate equipment

Businesses should be equipped with appropriate equipment to keep displays and printers in use and ensure the prompt, neat and clear output of ESI at all times.

3. Enable a search function for the ESI

If there is no system to preserve the ESI, the following alternatives may be used to ensure that there is a search function.

We support you in implementing the updated law in your business without making massive changes to the existing system.Kazuhiko Chiba, president and CPA, ECOVIS APO, Tokyo, Japan

Alternative 1

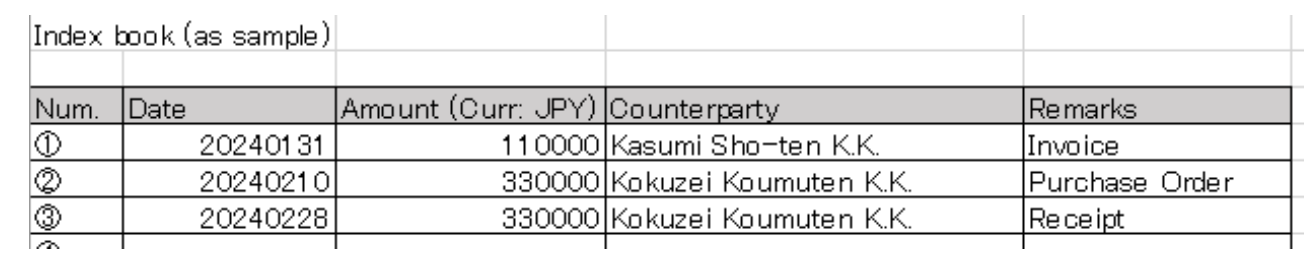

Prepare a list using spreadsheet software such as Excel to show (i) the date of transaction, (ii) the transaction amount and (iii) the name of the customers/vendors.

Alternative 2

Prepare the transaction data files using systematic file names to identify the above information (i), (ii) and (iii). These data files must be kept in the designated folder to optimise search functionality.

It is crucial that the electronic transaction data can be downloaded at any time upon request by tax auditors from the revenue authorities.

For further information please contact:

Kazuhiko Chiba, president and CPA, ECOVIS APO, Tokyo, Japan

Email: kazuhiko.chiba@ecovis.jp