Risk identification assessment and mitigation

Risk is an endless subject of the utmost importance to all businesses but which is often treated as an almost informal topic to be dealt with after all the “important” jobs have been done.

Risk has been defined as “any event or circumstance that has the potential to prevent or disrupt a company’s ability to achieve its business goals or objectives”.

Business risk can be internal (such as your strategy) or external (such as the global economy).

An effective business should not manage or treat all types of risk in the same way but should understand what type of risk they are facing, before considering how to deal with it.

Main Risk Classifications

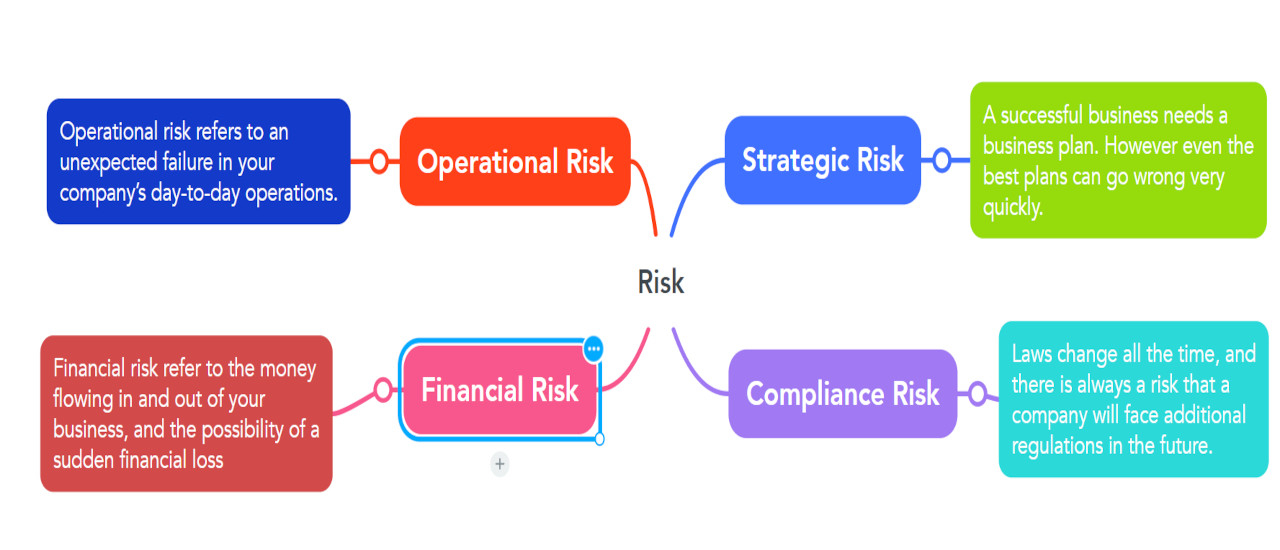

Strategic Risk

- A successful business needs a comprehensive, well-thought-out business plan. Strategic risk is the chance that your company’s strategy becomes less effective, and your company struggles to reach its goals as a result. It could be due to technological changes, a powerful new competitor entering the market, shifts in customer demand, spikes in the costs of raw materials, or any number of other large-scale changes.

- Example: A classic example is Kodak, which had such a dominant position in the film photography market that when one of its own engineers invented a digital camera in 1975, it saw the innovation as a threat to its core business model but failed to develop it.

Compliance Risk

- Laws change all the time, and there is always a risk that a company will face additional regulations in the future. And as the business expands, it might find itself needing to comply with new rules that did not apply before.

Operational Risk

- Operational risk refers to an unexpected failure in your company’s day-to-day operations. It could be a technical failure, like a server outage, or it could be caused by your people or processes.

Financial Risk

- Most categories of risk have a financial impact, in terms of extra costs or lost revenue. But the category of financial risk refers specifically to the money flowing in and out of your business, and the possibility of a sudden financial loss.

Risk Mitigation

The problem with risk is often that the existing executive team is too close and too used to the current situation to be able to evaluate business risks effectively and objectively. There are several software packages on the market designed specifically to take companies through a risk assessment and mitigation process. However, a cheaper and perhaps more effective alternative for small to medium sized companies is to have an independent professional carry out a risk assessment and report back potential areas for further consideration.

Call me if you would like to discuss this kind of service.